The first half of 2024 concluded with the S&P 500 Index up significantly for the 6-month period. A substantial portion of the market gains has been driven by the Artificial Intelligence (AI) investment theme, specifically led by Nvidia.

Thus far, many AI programs have publicly revealed their flaws or biases. It’s also becoming evident just how energy-intensive these technologies can be. For example, a ChatGPT query uses up to 25 times more energy than a Google search. This level of consumption cannot continue to be ignored.

Nvidia has had a historic run, which cannot be denied. Just a couple of years ago, cars and other technology-driven devices couldn’t be built and delivered due to a global chip shortage. Somehow, Nvidia has not been affected by this and seems to have as many chips as they need. We want to remind clients that we focus on consistently performing companies that have been able to grow their earnings and revenues through nearly any market and economic cycle. These companies also have a history of paying out dividends and executing stock buybacks for many years. Nvidia does not yet meet our criteria to be in our core stable of individual stocks, but many clients gain indirect exposure through several ETFs used in portfolios.

Although our analysis indicates that AI will have profound impacts on business, we think this technology is still rather immature as individuals and businesses learn the best ways to use it.

On the economic front, the inflationary environment continued to ease throughout these last 6 months, albeit at a slower pace. The expectations for Federal Reserve interest rate cuts this year have decreased from three, as of December 2023, to just one expected for the year.

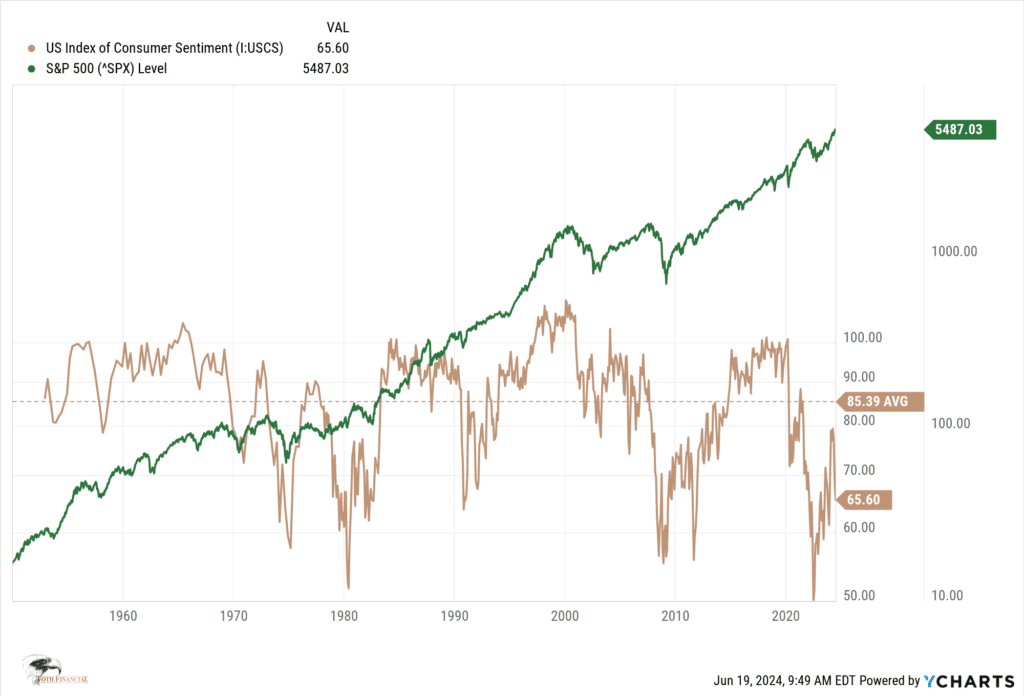

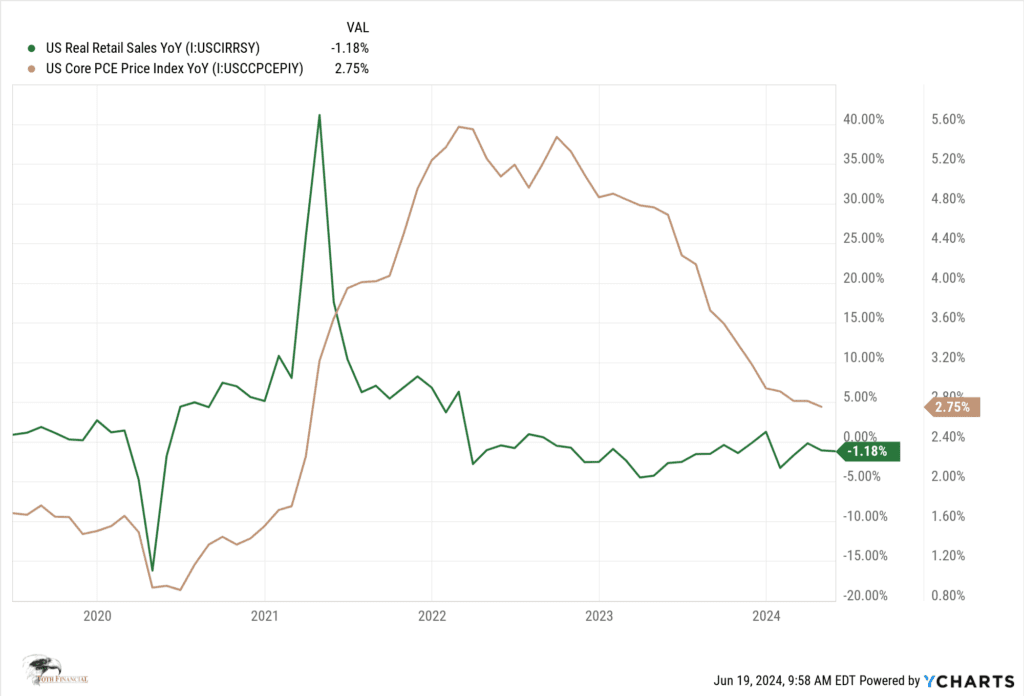

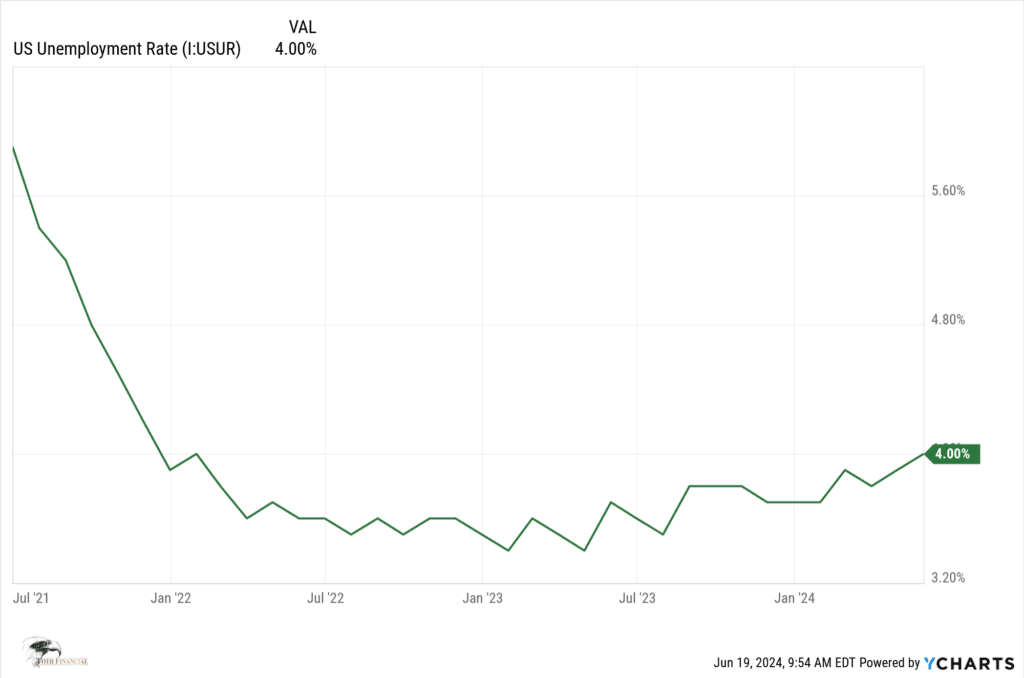

Consumer Sentiment (image 1), as measured by the University of Michigan, has been historically low for the past couple of years and is starting to fall again. Retail Sales (image 2) in May came in at a negative measure when adjusted for inflation. The Unemployment Rate (image 3) has slowly ticked up from a low of 3.4% in April 2023 to 4.0% as of May 2024. These are “bad news is good news” economic data points because they indicate that the Fed is achieving its goal of slowing the economy to slow inflation.

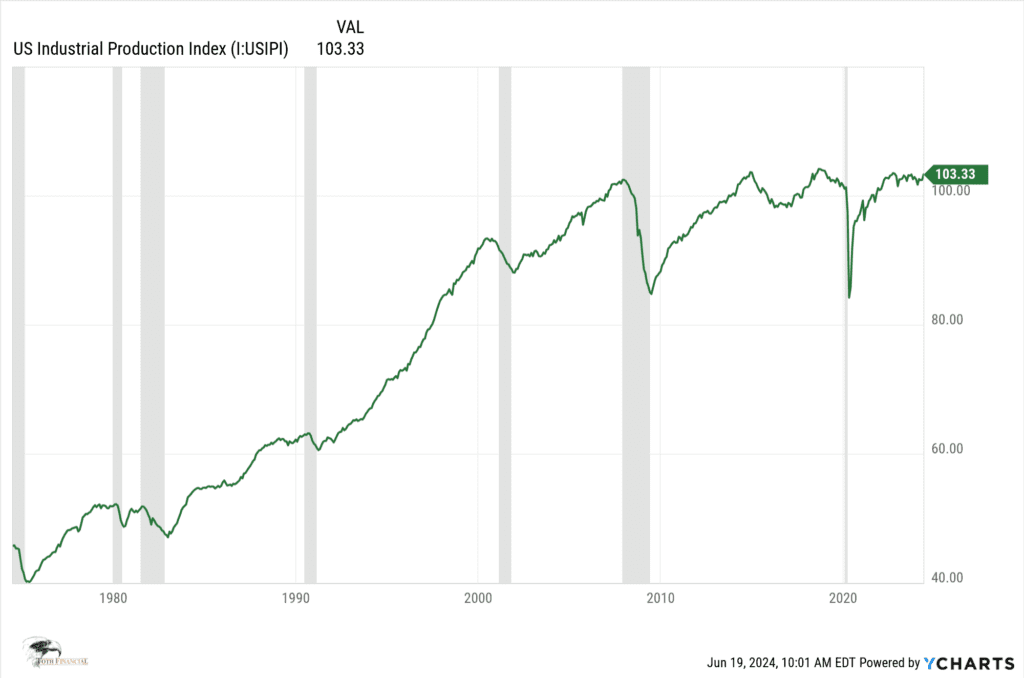

A bright spot in our economy has been Industrial Production (image 4). Past recessionary periods were led by, and saw a deep contraction of, Industrial Production within the US. This measure of productivity has been holding very steady for over two years and is certainly contributing to a relatively resilient economy as the Fed has raised interest rates rapidly.

As we near the Presidential election, volatility can be expected, and the possibility of a pullback would even be considered healthy. Regardless of what happens before the election, we anticipate a positive year end for the equity markets as the elected administration and its anticipated policies become known.

| Thomas A. Toth, Senior Chairman | Kenneth Bowen, II President & CEO |