Staying the Course Through Uncertainty and Headline Risk –

As we close out the first half of 2025, the S&P 500 reversed its first quarter downtrend and made an accelerated recovery; up 24.5% from the market bottom on April 8th and up 5.50% thus far in 2025.

The second quarter was dominated by much of the same as the first; heightened tariff uncertainty, trade negotiations, escalating conflicts around the globe, ambiguous economic data, and markets wrestling with shifting expectations around interest rates and global growth. Everchanging headlines present unique challenges to investors as markets attempt to price in risk only to see it change overnight. Despite the uncertainty, volatility and headline risks, the investment philosophy remains consistent: stay focused on quality, remain disciplined, and maintain a long-term perspective rooted in opportunity.

Much like in the first quarter, high-growth areas of the market — particularly technology and consumer discretionary sectors — have continued to experience the greater burden of market volatility; both up and down. Our core stocks, which prioritize companies with consistent earnings, durable cash flows, and strong balance sheets, have again demonstrated resilience and the ability to somewhat mitigate headline risk. The second quarter reinforced why we invest the way we do — not for short-term excitement (or fear), but for long-term compounding.

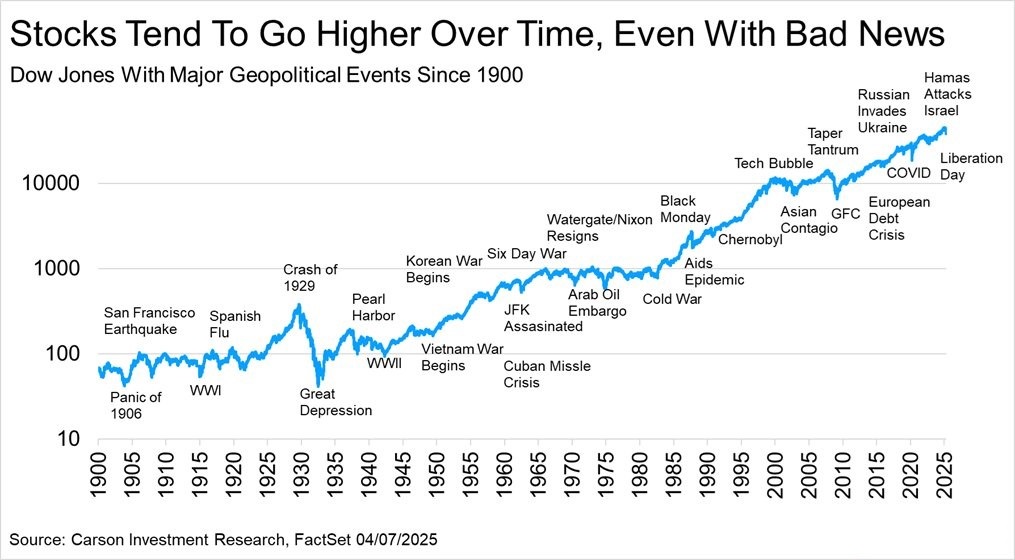

As a meaningful illustration to headline risk, the chart below demonstrates the acute nature of extraordinary world events, the immediate market response and rationale market conclusions after a period of examination.

As illustrated, markets have weathered some of the most challenging events in history — from world wars to financial crises, pandemics, and geopolitical conflicts. Despite these disruptions, the long-term trend has remained unmistakably upward. This pattern is what the investment world refers to as “climbing the wall of worry” — the idea that markets can and often do advance amid a backdrop of constant concern.

We are in one of those periods now where a world ordered for decades by globalization and geoeconomics has also become more grounded in geopolitical risks. The accumulating headlines such as tariffs, Russia-Ukraine war, Israel-Iran war, immigration policies and border relations have the potential to impact the global economic outlook, yet good quality companies will continue to effectively and positively navigate the uncertainty.

In last quarter’s commentary, we reminded investors of the value of discipline and optimism, stating:

“Bull markets have repeatedly demonstrated their ability to ‘climb a wall of worry,’ often defying bearish narratives. While market contractions are inevitable and their timing unpredictable, a focus on high-quality companies with proven resilience across economic cycles will situate portfolios for long-term success.”

That remains our position. While short-term headlines can drive daily volatility, they often obscure the more important story — that successful investing is about time in the market, not timing the market.

Looking ahead to the second half of 2025, we remain attentive but not reactive. Market volatility may persist as negotiations over tariffs unfold, geopolitical conflicts persist, the Fed weighs economic data, and ever-changing global events evolve. But as history has shown, markets have a remarkable capacity to absorb bad news, recalibrate, and move forward.

Our recommendation is unchanged: stay committed to a strategy built on quality and discipline. Focus on the businesses you own — many of which continue to deliver strong results quietly, without headline attention. These are the companies that have weathered past storms and are best positioned to endure whatever lies ahead.

The market’s path is never linear, but its direction over time has consistently rewarded patient, long-term investors. In periods like these, the importance of a time-tested investment approach becomes most evident.

| Thomas A. Toth, Senior Chairman | Kenneth Bowen, II President & CEO |